Microsoft 2022 Q3 results: Cloud growth steady, commercial bookings strengthen

Microsoft reported 2022 Q3 earnings of $2.22 on revenue of $49.4 billion, beating analyst estimates.

Commercial bookings grew 28% and Microsoft Cloud revenue rose 32% to $23.4 billion. Azure and other cloud services revenue growth at 46%.

Among other business highlights, the company reported:

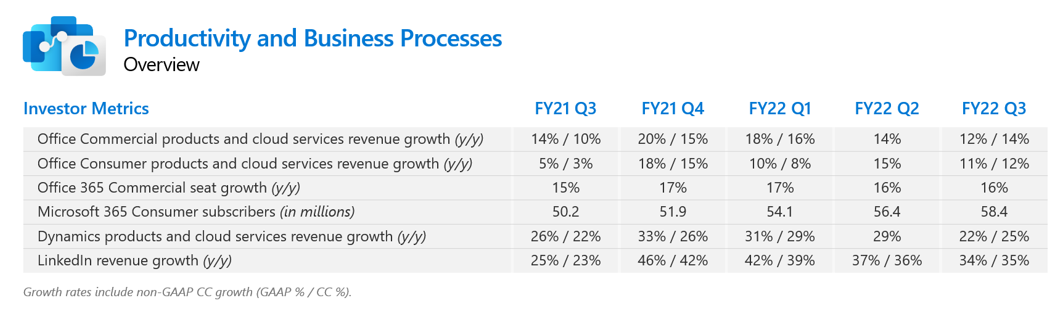

- Dynamics product and cloud service revenue rose 22%, with Dynamics 365 revenue growth of 35% (though each had a 3-point lift in constant currency)

- LinkedIn revenue growth of 34%

- Office 365 Commercial revenue growth of 17%

Net income was $16.7 billion, up 8% with operating income of 20.4 billion, up 19%.

In Q2 2022, Dynamics 365 revenue grew faster, at 45%, as did overall Dynamics revenue. Azure grew 46%, with Microsoft Cloud overall up 32%.

In Q3 2021, the company reported revenue of $45.3 billion and $2.71 earnings per share. Azure and other cloud services revenue grew 50% in that quarter, with Dynamics products and cloud services revenue increasing 31% overall and D365 revenue up 48%.

Unlike in past reports, the company did not share Power Platform growth figures.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here